how do you calculate cash flow to creditors

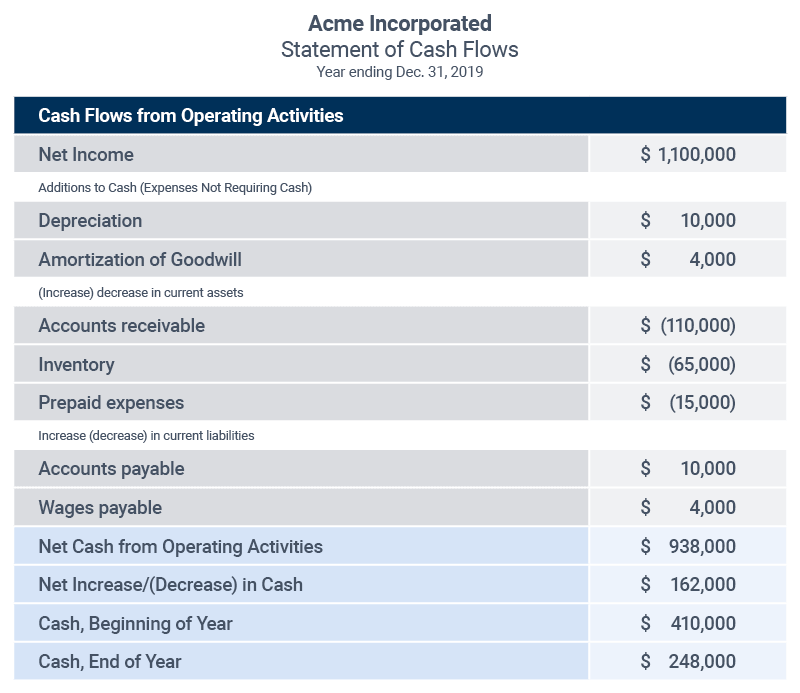

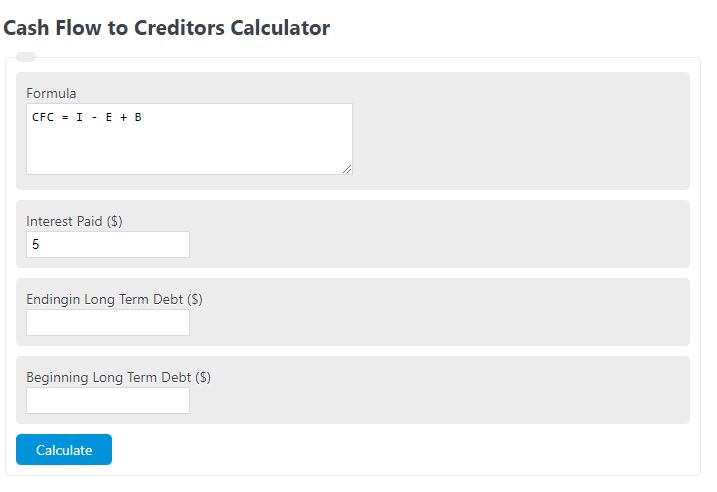

Web Enter the total interest paid ending long-term debt and beginning long-term debt into the calculator to determine the cash flow to creditors. The direct method lists and adds all of the cash transactions including.

Direct Vs Indirect The Best Cash Flow Method Vena

These will be used.

. Where I Interest Paid. Cash flow to creditors is a term that is often used to describe how much you are due for money from a creditor. Web Cash Flow to Creditors I - E B.

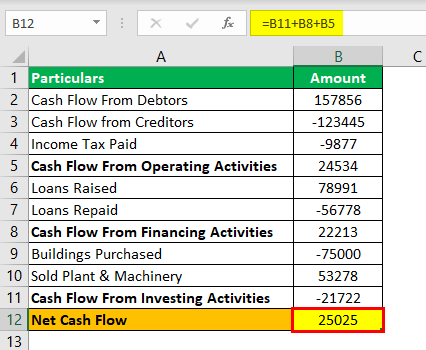

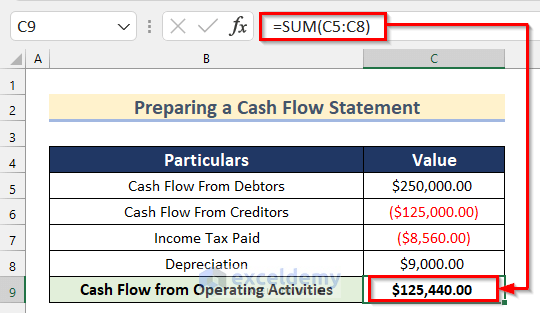

The formula of cash flow to creditors interest paid net new borrowing. Web Operating Cash Flow Net Income All Non-Cash Expenses Net Increase in Working Capital. The items in the cash flow statement are not all actual cash flows but reasons why cash.

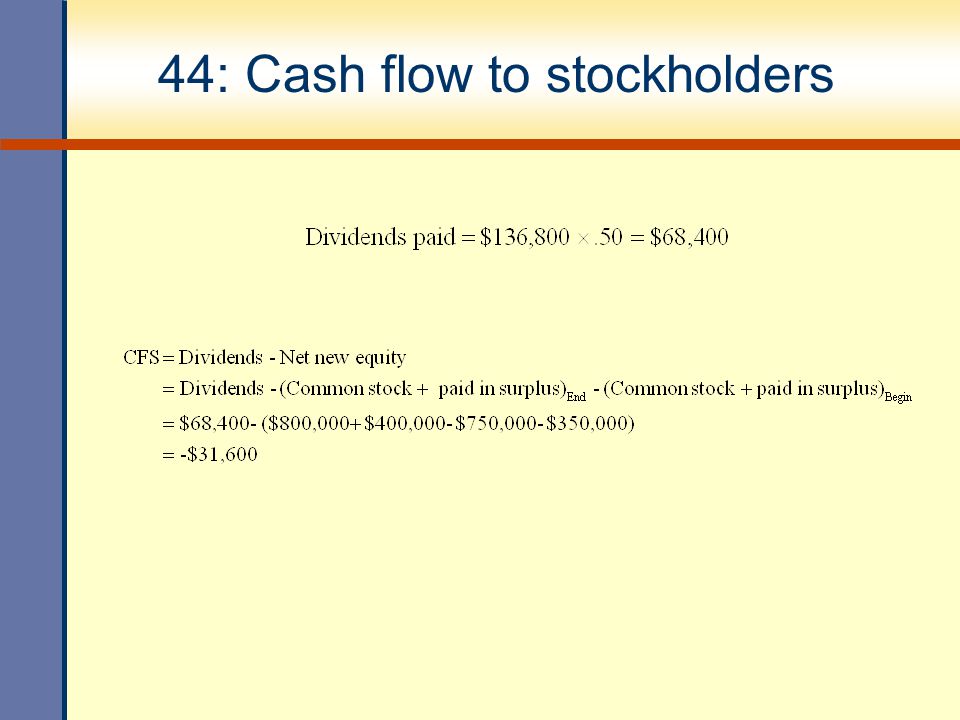

Web Heres how this formula would work. Web Step 1. Cash Flow to Stockholders.

Web There are two different methods that can be used to calculate cash flow. CFC I E B Where CFC is the cash flow to creditors I is the total interest paid E is the ending long term debt B is the beginning. Free Cash Flow 227 million 32 million 65 million 101 million.

How do we calculate each of these components Cash flow to Creditors Cash flow to Stockholders. Web How do you calculate cash flow to creditors if you are not given long term debt. Web Free Cash Flow Net Income Depreciation Change in Working Capital Capex.

Where I Interest Paid E Ending Long Term Debt B Beginning Long Term Debt. Web The final amount with the Direct method for cash flow statement will be made by calculating all the above items which will give us a Net Increase in Cash and Cash Equivalents. Web The following formula is used to calculate the cash flow to creditors.

Free Cash Flow. Web Equation for calculate cash flow to creditors is Cash Flow to Creditors I - E B. Web Cash flow from Assets - Cash flow to creditors Cash flow to stockholders.

Web Why do they call it that. Cash flow to creditors is. Web So the best way to figure out if you have enough money to make your payments is to calculate how much you have already spent on things that could affect.

B Beginning Long Term Debt. At the very top of the working capital schedule reference sales and cost of goods sold from the income statement for all relevant periods. The simple formula above can be built on to include many.

Add the three amounts to determine the cash. E Ending Long Term Debt. Web Once they have these three numbers Johnson Paper Company can calculate their cash flow from assets.

Solved Use The Following Information For Taco Swell Inc Chegg Com

Operating Cash Flow Basics Smartsheet

Cash Flow Analysis Basics Benefits And How To Do It Netsuite

:max_bytes(150000):strip_icc()/TermDefinitions_CFF_finalv1-f2cdc1f2ec574548a8ccf94dd8cb7cfc.png)

Cash Flow From Financing Activities Cff Formula Calculations

Cash Flow To Creditors Calculator Calculator Academy

Net Cash Flow Formula Step By Step Calculation With Examples

How To Calculate Net Cash Flow In Excel 3 Suitable Examples

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Debtors Modano

Financial Statements Taxes And Cash Flow Ppt Video Online Download

How To Calculate Operating Cash Flow To Creditors

Solved Use The Following Information For Ingersoll Inc Assume The Course Hero

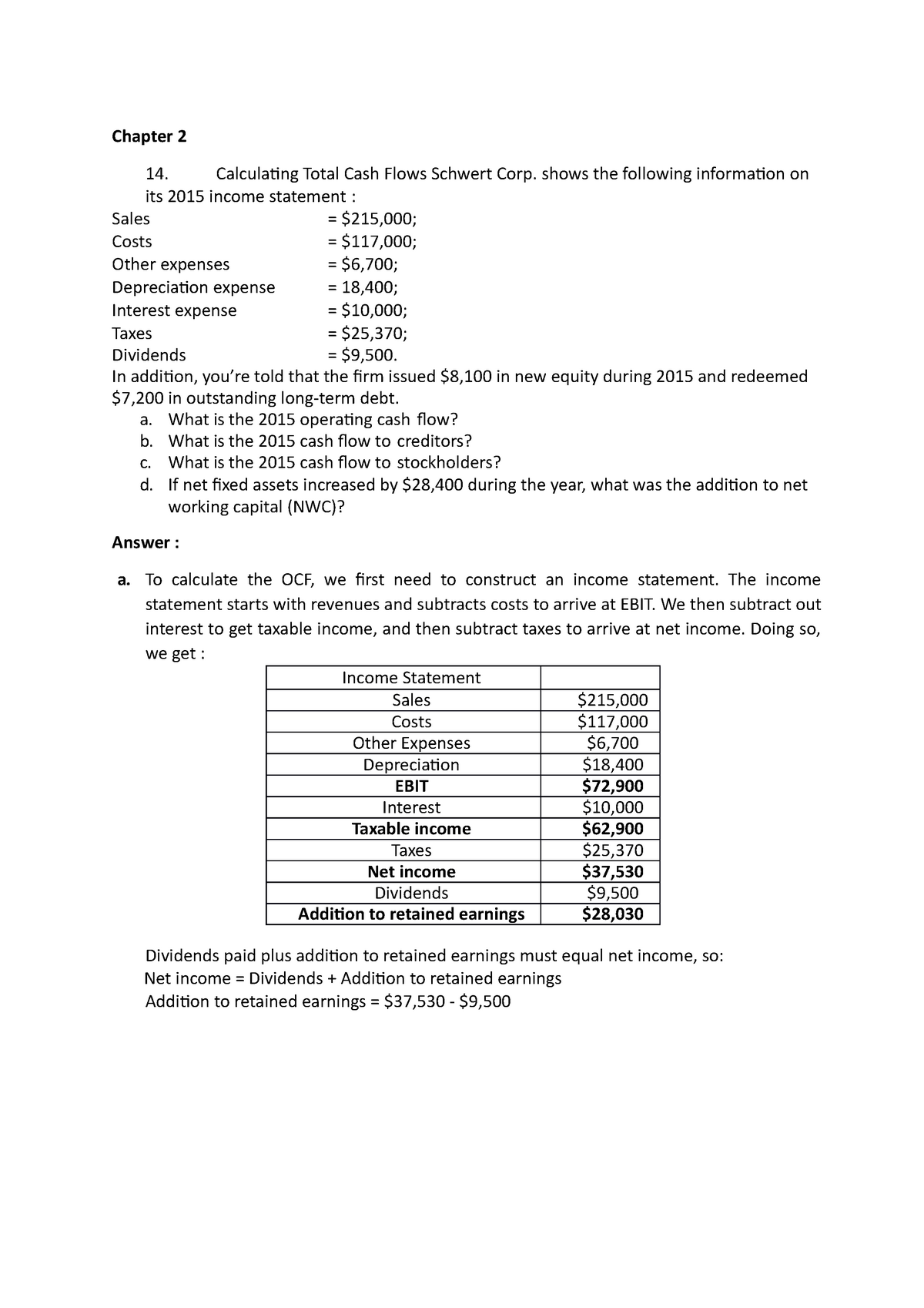

Assignment 1 Grade B Chapter 2 Calculating Total Cash Flows Schwert Corp Shows The Following Studocu

Solved Use The Following Information For Clarington Inc Assume The Tax Course Hero

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

How To Calculate Cash Flow 15 Steps With Pictures Wikihow

Could A Company S Cash Flow To Stockholders Be Negative In A Given Year And How Might This Come

Cash Flow From Operations Formula Calculator Excel Template

Cash Flow Definition How It Impacts Business And More Billtrust